Today I was in Washington, D.C., to testify before the U.S. International Trade Commission, which is considering imposing tariffs on solar imports.

My testimony was as follows:

Chairman Schmidtlein, Vice Chairman Johanson, Commissioner Williamson and Commissioner Broadbent, thank you for the opportunity to be here today.

My name is Tom Werner, and I’m the president and chief executive officer of SunPower, the nation’s second largest solar company. We design, manufacture and install the world’s highest efficiency solar technology. Based in Silicon Valley and founded over 30 years ago, we employ more than 1,000 people in the United States. This includes a robust R&D innovation team that directly shapes how we supply solar power components and systems around the world to residential, commercial and utility-scale markets. In 2016 alone, SunPower invested $120 million in R&D in the United States. Our customers include Campbell Soup Company, Fedex, Macy’s, Stanford University and Walmart; some of the nation’s largest investor-owned and publicly-owned utilities; and over half a million residences and small businesses.

Since 2003, I’ve had the privilege of being on the front lines of a dramatic energy industry evolution. During this period:

Solar power generation capacity has grown more than 100-fold worldwide, and cost has decreased to the point where CSPV is now competing against other sources of energy like natural gas, wind and thin film solar.

In 2016, the U.S. PV market hit an all-time high of over 14,000 MW, more than doubling since 2014. At the same time, China, Germany, and Japan have all produced more solar power than the U.S., making this a truly global market.

Last year alone, two percent of all new U.S. jobs were created by the solar industry and we collectively contributed $84 billion to the US Gross Domestic Product.1

Although government has played a key role in the growth and evolution of solar power, I am convinced that technology innovation and competitive markets are now the key drivers. With the federal investment tax credit set to wind down, we are on a glide path to being a fully self-sustaining industry.

The solar cell I am holding in my hand is an example of SunPower’s industry-leading back contact solar cell technology. This was developed originally at Stanford University and perfected in our Silicon Valley labs.

It is made using monocrystalline silicon and a unique patented architecture to deliver the highest sunlight-to-electricity conversion efficiency of any solar product on the market today. High efficiency delivers more energy from a given roof space or land area, which is particularly important for residential applications where SunPower has leading market share, and where our systems command a significant price premium. While it makes us more expensive in terms of up-front cost, we’re fully competitive in terms of the price per kilowatt-hour delivered over the life of the system. Our customers willingly pay that premium for a product that delivers better energy, long-term performance and reliability.

In 2006, our company’s founder, former Stanford University Professor Richard Swanson, outlined the correlation between the cost of solar power and global shipment volume. “Swanson’s Law” dictates that the cost of solar declines at a predictable rate as companies innovate, adopt those innovations at scale, and thereby increase production volumes.

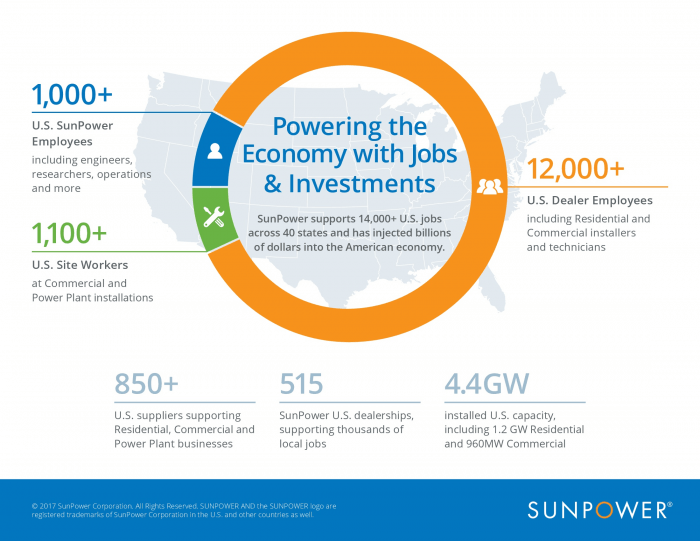

We have clear evidence of this effect as the cost of solar power has decreased by more than 60 percent over the last five years.2 This trend drives a virtuous cycle of employment, R&D investment and further cost declines across not only the solar panel industry and downstream channel partners, but also in our supply chain. In the case of SunPower, we source almost all silicon from our partners in Michigan and Tennessee; much of our power electronics from Colorado; and much of our metal products from Arizona and Minnesota. In fact, we have more than 14,000 direct and indirect workers, not including our American supply chain, across the country, as outlined in our slide. These workers would be vulnerable to solar market declines.

I can say without hesitation that customers are embracing solar power because of its cost effectiveness and long-term price certainty. A determination of injury in this case risks severely distorting the market and impairing customers’ ability to freely choose between competing energy options.

1The Solar Foundation’s Annual Report

2Solar Energy Industries Association