Editor's Note: For updated information on the solar ITC, please visit our solar resource on the subject.

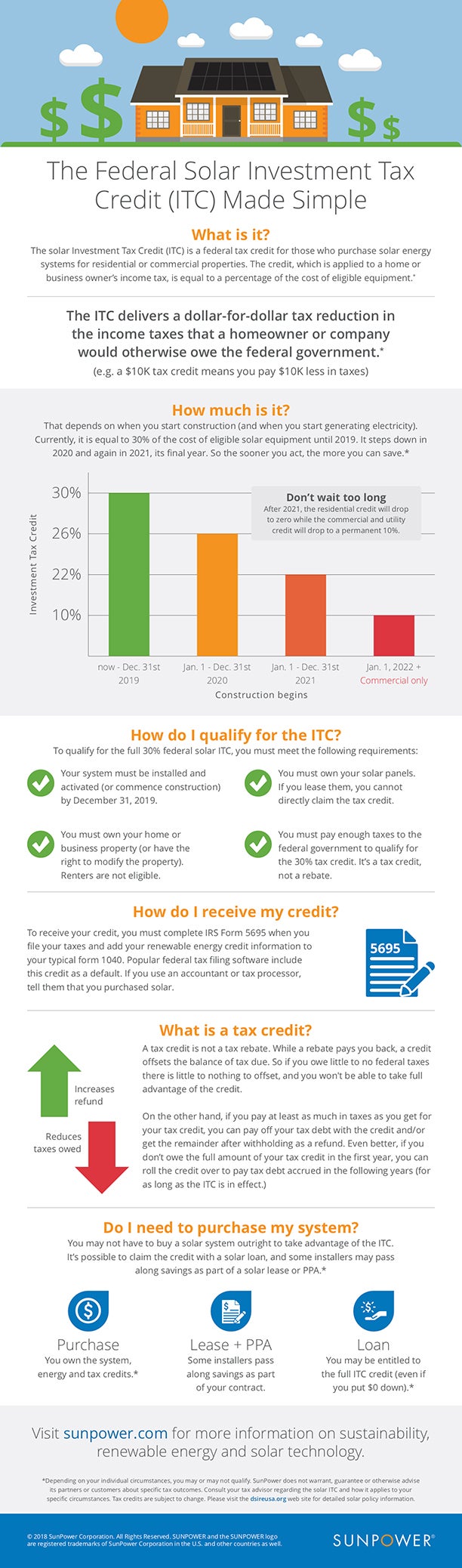

It’s tax season! If you’re considering a home solar system, it’s important to know the financial benefits of the federal investment tax credit because it’s going to be reduced after this year.

To celebrate the final year of the 30 percent federal tax credit on solar purchases,*Must purchase solar to qualify for Federal Income Tax Credit. Tax credits subject to change. SunPower does not warrant, guarantee or otherwise advise its partners or customers about specific tax outcomes. Consult your tax advisor regarding the solar tax credit and how it applies to your specific circumstances. Please visit the dsireusa.org website for detailed solar policy information. SunPower is offering a special rebate. If you’ve been waiting for a reason to take the next step, here’s a good one: For a limited time, you can receive a $1,040 mail-in rebate*Rebate Terms: Must purchase or lease SunPower Equinox system with X-Series panels and sign SunPower and/or Participating Dealer solar purchase contract, lease agreement or loan agreement for system on or before April 15, 2019. Before-rebate costs will vary depending on system specifications. Check with your SunPower installation contractor to confirm participation with this offer. Cannot be combined with other offers. Only available to new, first-time customers. May not be applied to quotes on existing proposals or past purchases. Lease program not available in CT, NV, AZ, HI, CO. SunPower rebate form must be completed and returned to SunPower within 90 days of the final invoice date. Void where prohibited. with the purchase or lease of a SunPower® Equinox® system with X-Series panels, one of the most efficient panels on the market.*Based on survey of datasheet values from websites of Top 20 manufacturers per IHS, as of January 2019.

Plus, by going solar now you may qualify for the 30 percent federal tax credit on solar purchases before the credit is reduced starting in 2020.*Must purchase solar to qualify for Federal Income Tax Credit. Tax credits subject to change. SunPower does not warrant, guarantee or otherwise advise its partners or customers about specific tax outcomes. Consult your tax advisor regarding the solar tax credit and how it applies to your specific circumstances. Please visit the dsireusa.org website for detailed solar policy information.

Learn more about the ITC in this infographic. And sign your new solar contract by April 15 to be eligible for the rebate.

Click to see how much you might save going solar.