Powering a Brighter Future

With decades of experience, we are a U.S.-based solar company committed to providing reliable and sustainable energy and storage solutions.

Clean energy and storage should be accessible to everyone. SunPower delivers all-in-one residential solar solutions with personal customer service, leading in sustainability through ethically sourced materials and low environmental impact.

With Decades of Experience and Expertise, We Know Solar

Meet Our Visionary

T.J. Rodgers

Chairman and CEO, SunPower

CYPRESS SEMICONDUCTOR

Thurman John “T.J.” Rodgers founded Cypress Semiconductor Corporation on December 1, 1982, and immediately began writing a business plan in his kitchen. He served a record 34 years as the Company’s President and Chief Executive Officer. (“I did not have one job for 34 years. I had dozens of jobs over the years, doing whatever Cypress needed at the time.”)

Cypress’s first‑round funding came in April 1983 from blue‑chip Sand Hill Road Venture firms, including Kleiner‑Perkins and Sequoia Capital. Cypress built a wafer fabrication plant in San Jose, California in a little more than one year after funding, and brought its first “Moore’s Law” CMOS memory chips to market in 1984, ahead of Intel, which was underutilizing Moore’s Law on the lesser NMOS technology at the time. Cypress became profitable and went public in May 1986, just 37 months after its first‑round funding. In 1999, Rodgers was appointed for a term as Chairman of the Semiconductor Industry Association (SIA).

Rodgers entrepreneurship awards at Cypress included the Encore Award from the Stanford University Business School as the 1988 Entrepreneurial Company of the Year and the 1991 Entrepreneur of the Year award from Ernst & Young. However, his most prized award is an unexpected one paragraph 1999 letter from Milton Friedman, congratulating Rodgers on his Wall Street Journal editorial in which he castigated government for corporate welfare – even for chip companies.

BUILDING SUNPOWER

Rodgers became involved in SunPower in 2001 in a chance coffee‑shop encounter with fellow Stanford classmate, Dick Swanson, who told Rodgers that he was having financial problems with his company SunPower, the 1985 startup that essentially created the solar industry as we know it today. In 2001, Rodgers wrote a personal investment check for $750,000 and joined the board of SunPower. After five quarters of vigorous debate, Rodgers finally convinced a balky Cypress board to invest in a 40% interest in SunPower. That investment was distributed in 2008 to Cypress shareholders as a stock dividend worth $2.6 billion. Cypress did more than invest to help SunPower – it modified its Austin, Texas wafer fabrication plant to train SunPower engineers on silicon manufacturing so that SunPower’s revolutionary A‑300 SunPower solar cell could come to market in high volume at low cost. In 2003, it helped design and build a 300’‑long “autoline” solar cell manufacturing line for SunPower’s new plant in the Philippines, which was built by Cypress facilities personnel. Each line produced 1,200 solar cells per hour in a low‑cost country, and when the autolines ramped revenue to $79 million in 2005, Rodgers guided SunPower through its initial public offering as the company’s first Chairman. In 2008, at the demand of Cypress shareholders, SunPower was spun out as an independent company after it had achieved $1.43 billion in revenue under CEO Tom Werner, a former Cypress employee. Rodgers left SunPower in 2010 after it was acquired by the French Oil Company, Total.

SUNPOWER BANKRUPTCY

Fourteen years later, Rodgers received a call from Werner, informing him that SunPower was filing for Chapter 11 bankruptcy. Rodgers then created a plan to run the company after bankruptcy that was court‑approved on September 30, 2024. He then raised the funds for his new solar company, Complete Solar, to buy the assets of the SunPower Corporation. Execution was difficult: the tiny 65‑person Complete Solar startup had to buy and integrate 2,901 employees from SunPower Corporation under intense cashflow and time pressure.

Rodgers, now age 77, is the Chairman of SunPower again, and its CEO as well. In two quarters after the September 2024 asset acquisition was approved, the integrated company has leaned down from 2,901 to 900 employees, twice achieved over $300 million in annualized revenue, and turned profitable and cash flow positive. Complete Solar also adopted the SunPower brand name and SPWR stock ticker symbol.

VENTURE CAPITALIST

As the head of Rodgers Capital LLC, Rodgers also invested in and sits on the board of Enphase (a $1.5 billion solar electronics company), Enovix (an advanced lithium-ion battery company), and BeSpoken (a bourbon whiskey startup that has patented a new proprietary fine spirits aging technology that uses 30 times less wood (trees) than the conventional process).

Rodgers also has invested in nine medium-size businesses in his Oshkosh, Wisconsin hometown ranging from a 1948‑vintage A&W rootbeer stand (that still uses high school girls on roller skates as waitresses) to the 128‑acre Oshkosh Country Club founded in 1898. Next year he will open the 32‑room “Northwestern Hotel” in a classic 1930 downtown building built for the local newspaper. The hotel will house a high‑end Italian restaurant with an Italian‑born chef. The Wisconsin businesses are run full time by his wife, Valeta Massey, who also runs their California wine business, which produces 3,000 cases of Pinot Noir annually in a custom winery housed in three 100‑yard deep caves bored 65’ under the vineyard planted on the 1,700’ peak of the Santa Cruz Mountains. Valeta, a former chip‑design manager from Cypress, is also a partner in and the CFO of their two‑employee venture capital firm.

MIDWESTERN ROOTS AND VALUES

Rodgers was born in Oshkosh, Wisconsin (pop. 66,184) on March 15, 1948, and played on two Oshkosh High School back‑to‑back state-championship football teams. He remembers playing a game against Green Bay West High School in Brown County Stadium, later renamed Lambeau Field after Green Bay Packer founder Curly Lambeau’s death in 1967.

Those championship teams led to his recruitment to play football at Dartmouth College, in an era when Ivy League rules did not allow athletic scholarships. At that time Dartmouth held classes on Saturday and when Rodgers missed both physics and chemistry classes due to away games, he stopped playing football, but later received a full academic scholarship from the Alfred P. Sloan Foundation. He graduated as Class of 1970 Salutatorian with double majors in chemistry and physics, and is currently a Trustee Emeritus of Dartmouth College, having served on the Dartmouth Board from 2004 to 2012, where he was a vocal opponent of administrative bloat and what was then called “political correctness” in academia. He endowed two Dartmouth professorships, one named the Lois L. Rodgers professor after his mother, a fifth‑grade teacher.

Rodgers chose Stanford over Princeton and several other schools for graduate work to be able to move to California. He received his Master’s and PhD degrees in electrical engineering at Stanford, which resides in Palo Alto, California, the literal birthplace of Silicon Valley, where the Hewlett‑Packard company moved off of the Stanford campus by renting a garage on Addison Street in 1939, widely considered to be the beginning of “Silicon Valley.” Rodgers paid for his education by running chip‑making equipment in the Stanford Integrated Circuits Laboratory. One of four sections in his PhD thesis dealt with his patent on “VMOS” semiconductor technology, a chip‑making process that used vertical stacking transistors to increase packing density. He led the effort to commercialize VMOS at Silicon Valley’s American Microsystems and was overwhelmed by Intel’s “Moore’s Law” technology juggernaut. Finally, he ran the static RAM memory product line at Intel’s archrival, Advanced Micro Devices (AMD) until 1982, when he started Cypress.

After Rodgers retired from Cypress Semiconductor in 2017 at age 69, he was asked for help by John Doerr, a 10‑year Cypress director and current Chairman of VC firm Kleiner‑Perkins. After a reflexive “yes,” Rodgers dove into turning around Enphase, a promising solar electronics startup company. Eight years later, Rodgers is still on the Enphase board (“I don’t have to work much anymore; I sit in the front seat, watch the board presentation, which is always a ‘good movie,’ and leave feeling good.”). Enphase is now a very profitable $1.5 billion solar microinverter and battery powerhouse run by Badri Kothandaraman, a former Cypress EVP who worked directly for Rodgers. Rodgers invested in Enphase at $0.92 per share. Today, the ENPH share price has risen to $60.

CHARITY

Rodgers is now putting his money into mini‑endowments – using knowledge gained on the Dartmouth board – to support chosen charities in perpetuity after his death. He judges his charities as critically as his portfolio companies (“The only break they get is not to have to make 20% profit on the bottom line.”).

In 2016, Rodgers received the “Champion of Diversity” award from the California Association of African American Educators “for 20 years of financial and personal support.” He was also the first Silicon Valley CEO to volunteer to lead the annual food drive of Silicon Valley’s Second Harvest Food Bank (SHFB). Cypress won the SHFB’s hotly contested corporate food donation competition by donating an average of over 1,000 pounds of food per employee in his last year – and for 19 consecutive years before that. In 2004, Rodgers dedicated the Cypress Semiconductor Spinal Cord Rehabilitation Gymnasium at the Santa Clara Valley Medical Center, and one year later, the Cypress Maternal Outreach Mobile, a clinic-on-wheels used to help prevent avoidable pregnancy problems in urban areas with limited pre-natal medical resources. In 2022, T.J. & Valeta Rodgers were honored for leading a funding drive to build a new headquarters for Coastal Kids, a 132‑nurse organization that cares for chronically ill children at their homes to avoid the hospitalization that would otherwise be necessary. In 2023, Rodgers designed and built a 32‑unit housing development to help homeless families in his hometown of Oshkosh, Wisconsin. (“It’s great to write a check, but I like helping charities personally.”)

SUNPOWER VISION

Powering America since 1985

A message from TJ Rodgers, SunPower CEO

Given that more than 70 solar companies went out of business last year, any vision for SunPower's future must begin with a solid financial foundation. Consequently, the vision for 2025-2026 is to get from our current $300 million revenue run rate to over $1 billion as quickly as possible and grow expenses much more slowly than that to achieve solid profitability and build cash reserves. The reader should understand that this is the personal vision of T.J. Rodgers, not a forecast. And even when aggressive vision statements are achieved, as happened at Cypress Semiconductor and Enphase Energy, they are rarely achieved on the exact path described in an early vision statement, which nonetheless is necessary to let employees know where we have to get, so when our vision is inevitably disrupted (think about tariff uncertainty), the employees continue to head in the right direction, but invent a new path.

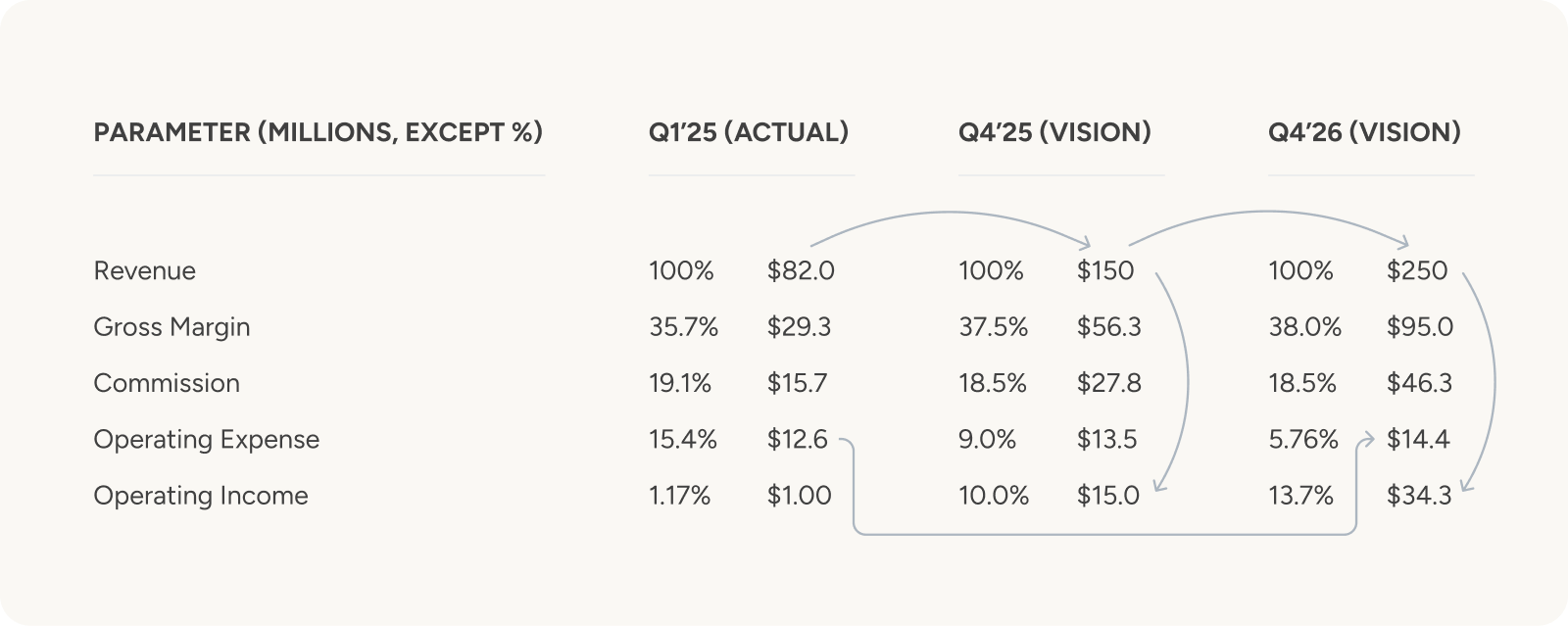

Accordingly, one feasible path to the financial vision is shown below. It assumes rapid revenue growth via acquisition, which is common in the depressed solar industry today, and a conservatively calculated P&L statement consistent with that growth:

If we can grow rapidly from the current $82 million per quarter to $150 million per quarter in 2025 and to $250 million per quarter in 2026, that would drive the bottom line in a compelling way, even with conservative assumptions. Cypress made 26 acquisitions during my 34 years there, so we have excellent acquisition business processes, but acquiring a solar company is much trickier than acquiring a semiconductor company, so we are moving cautiously.

Finally, we want to regain the high technical standards of the SunPower brand, which was synonymous with innovation and excellence at fair retail prices. For this we are pursuing two major technology paths: to design and bring to market world‑class solar panels in partnership with a leading panel supplier, and to create state-of-the-art energy storage systems with our partner Enphase Energy.

*See 8-K filed by the company on April 21, 2025 regarding forward-looking statements.